Chart of Accounts COA WAAM Office of Financial Management

- Post AuthorBy Peran Perempuan

- Post DateTue Jan 19 2021

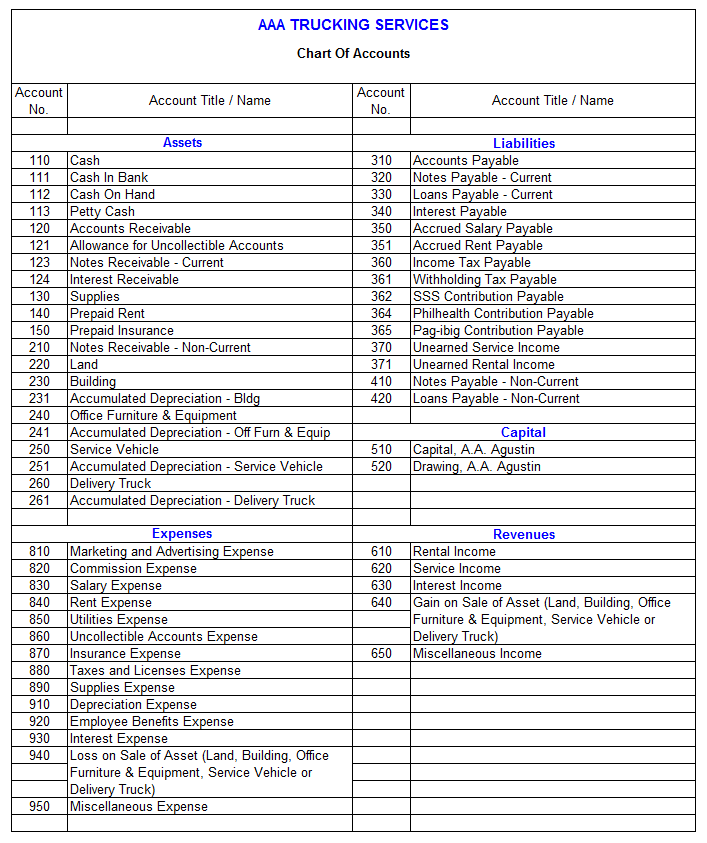

The account names will depend on your type of business, but the classification and grouping should be similar to the sample chart of accounts. The chart of accounts is useful in maintaining consistency and data integrity in recording transactions. A chart of accounts is a list of all accounts used by a company in its accounting system.

What are the best practices for integrating a chart of accounts with accounting software or ERP systems?

Now, the trial balance (the summary of all account balances) checking account balance reflects $125,453 at the end of May which is included in the financial statements. As businesses grow, these technologies can adapt to changing needs, such as incorporating new accounts or modifying existing ones, thus offering scalability. Moreover, technology streamlines the audit process by organizing financial data in an easily accessible manner for auditors. Finally, through advanced analytics, technology can offer insights for further optimization of the chart of accounts, identifying trends and areas for improvement. By ensuring it is well-organized, logically structured, and fully integrated with accounting software that supports real-time data processing and analysis.

Time Value of Money

I have primarily audited governments, nonprofits, and small businesses for the last forty years. So, let me summarize and say once more what the accounting sequence is. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Adding Nominal Codes

To check what information is needed, look at previous code details, which should help. For bigger companies, the accounts may be divided into several sub-accounts. Second, let’s see how the journal entries feed into the general ledger which feeds into the trial balance. So, a company can use account coding to generate certain information, such as total cash. Update the COA at least annually or when significant changes occur, such as business expansion, diversification, or changes in accounting regulations.

The exact layout of the accounting chart of accounts is a matter of choice depending on the exact reporting requirements of the business. The important point to remember is not to over complicate the chart of accounts. This sample chart of accounts structure allows the business to easily identify accounts and account codes enabling transactions to be posted and the trial balance and financial statements to be prepared. The COA is usually hierarchical, with accounts organized in categories and subcategories.

The balance sheet accounts

- For example, many accounts that are essential in manufacturing are not commonly used by retail businesses, including the composition of cost of goods sold (COGS).

- So, let me summarize and say once more what the accounting sequence is.

- To achieve this, COA design should incorporate both hierarchical and functional perspectives, by categorizing accounts to reflect the structure and operations of the organization.

A chart of accounts (COA) is a crucial component of a company’s accounting system, serving as an index of all financial accounts within the general ledger. Organized into categories and line items, it helps businesses track all financial transactions during a specific accounting period. The fundamental role of a COA in financial reporting and analysis makes it an essential element for businesses of all sizes. FreshBooks will help you stay organized with a user-friendly interface that keeps things simple.

Integrating a COA with accounting software boosts automation and accuracy in your financial management processes. The software handles the tracking of transactions across different accounts, ensuring real-time financial data is both precise and easily accessible. Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate accountant and bookkeeper stories line items in your chart of accounts for different types of income. This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts.

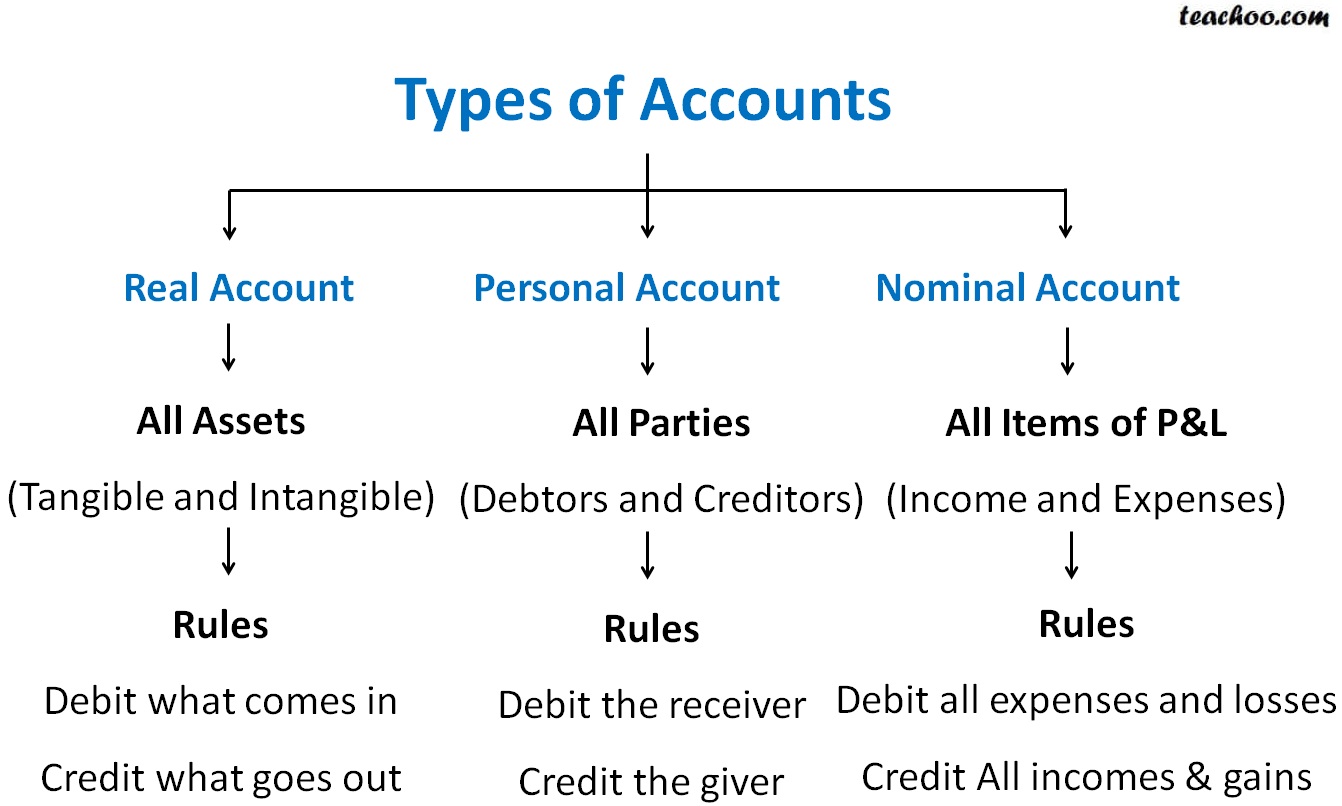

Setting up a COA in software like QuickBooks Online involves creating a list of categories to distinguish financial transactions. These categories typically include assets, liabilities, shareholder’s equity for the balance sheet, and revenue and expenses for the income statement. A chart of accounts organizes your finances into a streamlined system of numbered accounts. You can customize your COA so that the structure reflects the specific needs of your business. A chart of accounts is a tool used to categorize and organize all the financial transactions in a company’s accounting system.

Large and small companies use a COA to organize their finances and give interested parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards. A chart of accounts is a catalog of account names used to categorize transactions and keep your business’s financial history organized. The list typically displays account names, details, codes and balances. There’s often an option to view all the transactions within a particular account, too.

Web kolaboratif, konten adalah tanggung jawab penulis (Redaksi)